Nykaa Profitability Shift: What Changed and What US CMA Students Can Learn

Introduction

In the fast-moving world of e-commerce, profitability is often elusive. Many startups chase growth at all costs, only to find that expanding top-line revenue does not necessarily lead to bottom-line health. Nykaa, India’s beauty and lifestyle e-commerce powerhouse, has bucked that trend by evolving its financial performance from a growth-centric model to one emphasizing sustainable profitability.

This shift matters not just for investors but for finance professionals and US CMA aspirants. It is a real-world case study in how strategic financial decisions, cost management, segmental focus, and margin optimization drive meaningful profit outcomes.

In this blog, we explore why Nykaa’s profitability has improved, what business levers contributed to this shift, and what US CMA students can learn from it as they build strategic finance careers.

Understanding Nykaa’s Business and Profit Challenges

Nykaa, operated by FSN E-Commerce Ventures, started as an online beauty retailer in India and quickly expanded into fashion, wellness, retail stores, and private label brands. Its diversified portfolio was initially a strength for growth, but it also made profitability harder to achieve.

Historically, e-commerce firms reinvest heavily in customer acquisition, discounts, logistics, and inventory. These investments boost revenue but suppress margins, making profit a distant target.

Nykaa’s journey reflects this typical pattern, followed by a classic strategic transition from growth-at-all-costs to sustainable profit focus. The shift took place through a combination of segment prioritization, margin expansion tactics, operational efficiencies, and strategic cost control.

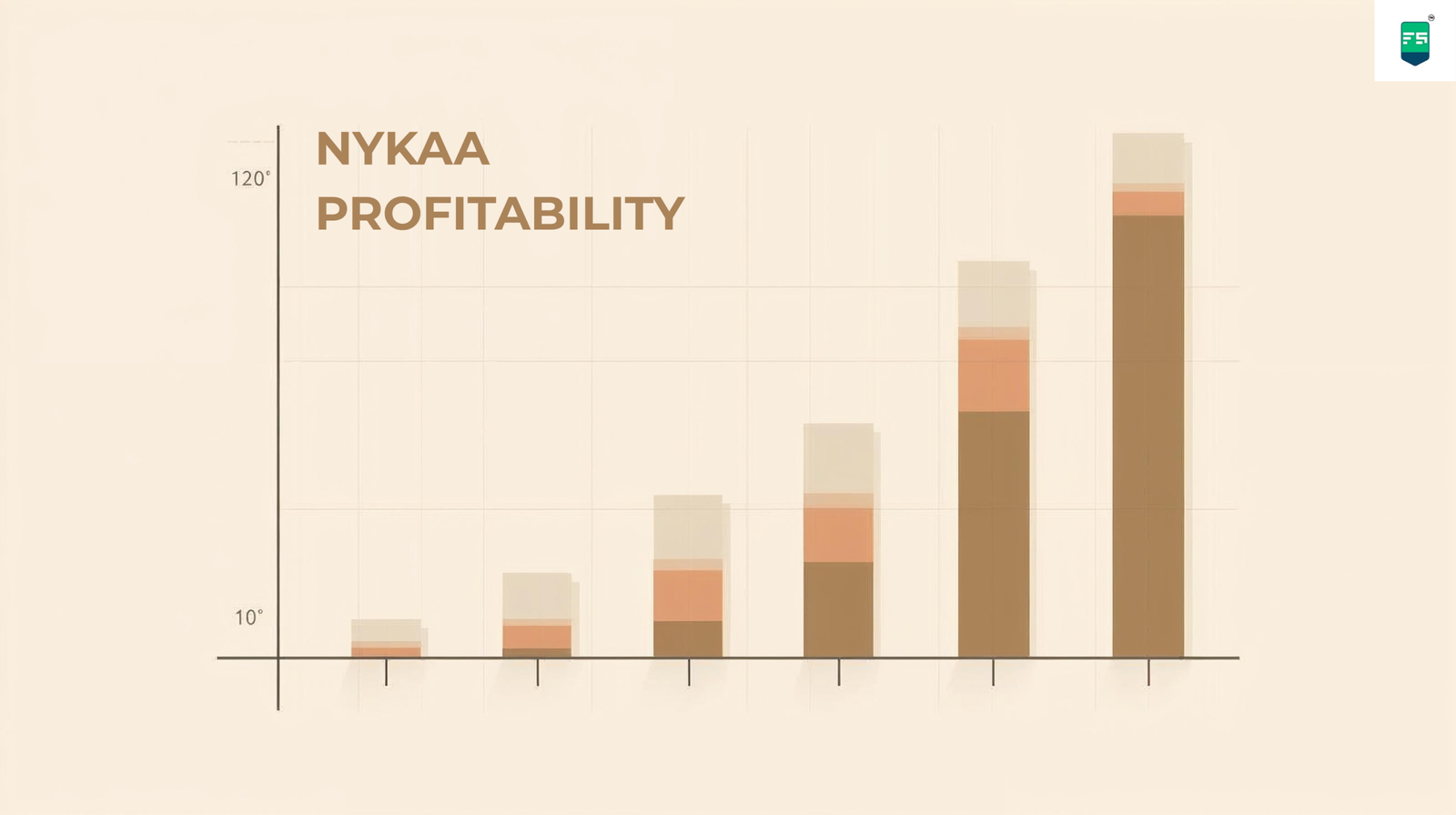

Profitability Metrics: A Data Snapshot

Let us first look at how Nykaa’s profitability has moved across recent quarters and fiscal year ends. These shifts reveal the real transformation in financial outcomes.

Profit and Margin Improvement Over Time

| Period | Net Profit Change (YoY) | Revenue Growth (YoY) | EBITDA Margin | Key Drivers |

|---|---|---|---|---|

| Q3 FY25 | Profit up 61% | Revenue up 27% | 6.2% | Beauty segment momentum, margin control |

| Q4 FY25 | Profit up 193% | Revenue up 24% | 6.5% | Higher premium product mix, cost management |

| Q1 FY26 | Profit up 79% | Revenue up 23% | ~6.5% | Omni channel expansion, House of Nykaa growth |

| H1 FY26 | Profit up 193% | Revenue up 24% | 6.8% | Higher GMV, improved segment mix |

These figures show that Nykaa’s bottom line has strengthened consistently while maintaining solid top-line expansion. This combination is rare among e-commerce players, and it reflects deeper financial discipline.

What Drove the Profitability Shift

1. Focus on Core Beauty Segment

The beauty and personal care (BPC) business remains Nykaa’s core revenue driver. In multiple recent quarters, this segment contributed a majority of revenue and positive margin effects. In Q3 FY25, the beauty vertical saw accelerated growth in gross merchandise value (GMV) and customer base expansion, helping overall margins expand. The New Indian Express

Nykaa’s premiumization strategy, with deeper partnerships with global brands and focus on higher-margin beauty products, allowed gross margins to improve. In the Q4 FY25 results, gross margins expanded as a result of customers increasingly purchasing more premium offerings.

This shift to higher-margin categories is a classic profitability strategy taught in the US CMA performance management curriculum, making this a valuable real-world application of managerial accounting concepts.

2. Operational Efficiency and Cost Control

Profitability is not just about increasing revenue. Cost structure and operational efficiency play a critical role.

Nykaa has focused on improving gross margins and optimizing selling, general, and administrative expenses. In Q4 FY25, EBITDA rose significantly and margins expanded, signaling better cost control relative to revenue growth.

Working capital efficiency also improved with tighter control over inventory turns, receivables, and payables, which improved cash flow and reduced financing costs, further contributing to improved profitability.

3. Strategic Use of Omnichannel Growth

Nykaa’s profitability shift was not just digital. Brick-and-mortar retail expansions were integrated strategically rather than as stand-alone cost centers.

In Q1 FY26, Nykaa’s profitable offline stores contributed significantly to beauty category growth. The expansion of physical retail reinforced brand presence and provided higher customer engagement and repeat purchases — turning what could be a cost center into a profitable channel.

This application of channel optimization strategy is a powerful lesson for US CMA students preparing for finance leadership roles.

4. Improved Performance in Previously Loss-Making Segments

Nykaa’s fashion vertical had been historically unprofitable. However, recent data shows a notable recovery in fashion GMV and narrowing losses, indicating better cost structure and revenue mix management.

This signifies strategic segmental portfolio management — reducing drag on the overall business and reallocating resources to high-margin areas.

5. Owned Brands and Premium Partnerships

Nykaa’s “House of Nykaa” partnership strategy and its own label brands have been growing faster than the overall platform.

In Q4 FY25 results, owned brand GMV showed significant contribution to beauty revenue, indicating that focus on proprietary and exclusive offerings can expand margins and brand loyalty.

For US CMA students, this highlights the importance of product mix strategy and its impact on profitability.

Profitability Flow Chart: From Revenue to Net Profit

Below is a simplified flow chart illustrating how key factors contributed to profit shifts. This is particularly helpful for finance students and professionals to understand how operational levers translate into financial outcomes.

Profitability Flow Chart

Revenue Growth

→ Better segment mix (Beauty > Fashion)

→ Higher margin products & premiumization

→ Expansion of profitable channels (e-commerce + offline)

→ Operational cost management

→ Improved working capital efficiency

→ EBITDA expansion

→ Net Profit growth

This flow aligns with principles in management accounting and performance evaluation frameworks — concepts central to the US CMA syllabus.

What This Profitability Shift Means for Finance Professionals

Nykaa’s profitability shift is not just a corporate milestone. For finance students and future professionals, especially those pursuing US CMA certification, it provides a live case on how financial strategy drives business outcomes.

Here are key learnings:

Revenue Segmentation and Margin Focus

Understanding how margins vary across products and customer segments and focusing on high-margin categories can significantly improve profitability.

Cost Management Practices

Tight control over operating expenses and leveraging scale economies are essential for sustainable profits.

Channel and Portfolio Strategy

Balancing multiple sales channels and optimizing the mix of profitable vs high-cost segments contributes to bottom-line growth.

Cash Flow and Working Capital Optimization

Effectively managing inventory and receivables improves operational cash flow — a critical factor in profit sustainability.

These topics are part of strategic financial management and cost accounting — crucial areas in the US CMA curriculum where practical application enhances professional effectiveness.

Why This Matters for US CMA Students

The US CMA certification is designed for professionals who want to bridge accounting with strategic business leadership. Nykaa’s recent financial performance exemplifies how financial insights can influence business strategy.

For US CMA students, case studies like Nykaa enable:

Concept Application

Applying theoretical knowledge to real corporate scenarios strengthens understanding and analytical capability.

Strategic Thinking

Understanding how financial decisions impact broader business outcomes deepens strategic mindset.

Career Readiness

Employers in consulting, corporate finance, and management roles value candidates who can interpret real financial shifts and recommend actions.

Investing in the right US CMA preparation ensures students are not only ready for certification exams but also for real challenges in finance careers.

FinStreet prepares students with a curriculum that bridges this gap between exam concepts and industry application, emphasizing case studies, real data interpretation, and strategic thinking.

Why FinStreet

FinStreet is a career-focused US CMA institute built for modern finance professionals. It goes beyond exam coaching and prepares candidates for the strategic challenges reflected in case studies such as Nykaa’s profitability transformation.

How FinStreet Supports US CMA Aspirants

Structured Mentorship

FinStreet offers personalized mentorship that helps students understand core financial concepts in context.

Strategic Exam Planning

Customized study plans tailored to individual schedules ensure efficient progress.

Real-World Case Integration

Discussions on real company performance and financial strategy equip students with practical insights applicable to corporate roles.

Ongoing Doubt Solving

Dedicated doubt resolution and conceptual reinforcement enable deep learning.

FinStreet prepares students to perform at the intersection of financial expertise and business strategy — a skill that helped companies like Nykaa improve profitability and sustain growth.

Official Website

https://www.finstreet.in

Instagram

https://www.instagram.com/finstreetofficial

YouTube

https://www.youtube.com/@FinStreet

Conclusion

Nykaa’s profitability shift demonstrates how strategic financial focus, margin management, operational discipline, and segmental prioritization can transform business outcomes. For US CMA students and professionals, this evolution provides a practical lesson in how financial leadership drives corporate success.

In an era where finance roles are increasingly strategic, understanding real business shifts lends a competitive advantage. US CMA training that integrates conceptual clarity with case application prepares finance professionals not just to interpret numbers but to shape business decisions.

Call to Action

Enroll in FinStreet’s US CMA program today.

Book a free counselling session with a US CMA mentor.

Join FinStreet’s CMA newsletter for weekly professional insights.