Rating Billionaire Spending Habits and Lessons for US CMA Professionals

Introduction

Billionaires are often portrayed as extravagant spenders, surrounded by luxury cars, private jets, and sprawling estates. While these images capture headlines, they only reveal a fraction of the truth. Most billionaires manage their wealth with remarkable discipline, prioritizing strategic investments, risk management, and value creation over mere consumption.

For finance students and professionals, particularly those pursuing the US CMA designation, studying billionaire spending habits provides invaluable insights. The strategies that billionaires use to protect and grow their wealth mirror the financial planning, performance evaluation, and strategic decision-making principles taught in the US CMA curriculum. Understanding these habits not only builds financial intelligence but also strengthens the analytical and managerial skills that US CMA professionals need in real-world business contexts.

Debunking the Myth: Billionaire Spending Isn’t Reckless

Popular culture often highlights the luxury lifestyle of billionaires, giving the impression that wealth automatically translates to reckless consumption. In reality, high-net-worth individuals spend carefully, focusing their resources on investments that generate returns, protect assets, or create strategic advantages. Lifestyle expenditures are deliberate, and discretionary spending rarely dominates their financial planning.

This controlled approach parallels the US CMA philosophy, where financial decisions are evaluated based on their impact on profitability, risk, and long-term value. US CMA aspirants learn to differentiate between expenses that add value and costs that erode capital—a concept that billionaires exemplify in practice.

How Billionaires Think About Money

Billionaires view money as a tool for generating further opportunities rather than as a reward to be consumed immediately. Their spending is guided by questions such as:

- Will this expense create measurable value?

- Does it enhance efficiency or leverage?

- Does it safeguard future earning potential?

- Will it strengthen influence or brand?

These decision-making patterns align directly with US CMA principles. For example, evaluating investment decisions, analyzing cost-benefit trade-offs, and assessing risk are central skills in the CMA curriculum, and observing billionaire behavior reinforces these concepts in a practical context.

Core Categories of Billionaire Spending

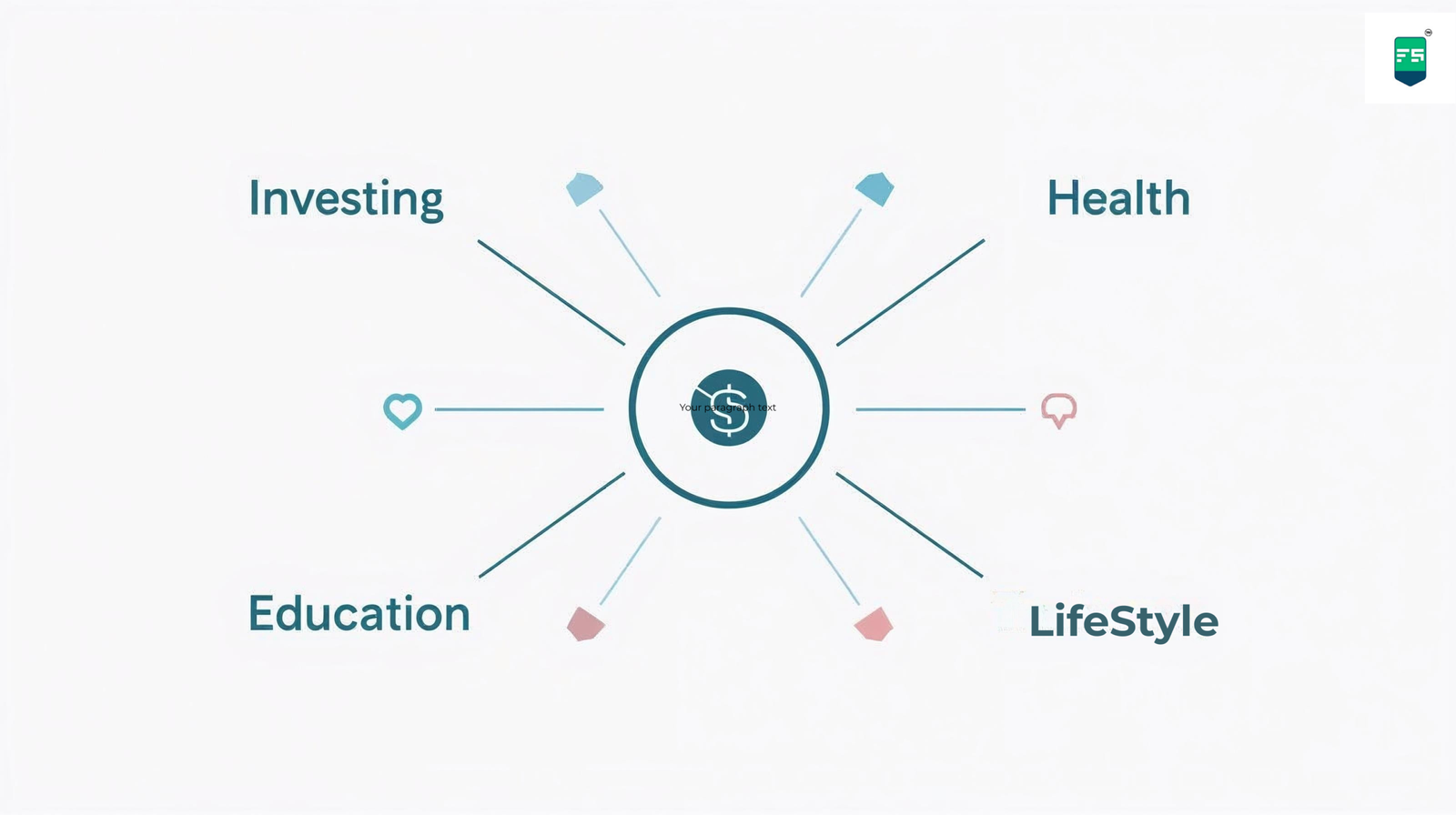

While each billionaire has unique priorities, their spending generally falls into strategic categories: investments, health and longevity, time-saving services, education, branding, and controlled personal luxury. Most expenditures are evaluated for their long-term impact rather than short-term satisfaction.

Rating Spending Habits

| Spending Habit | Financial Intelligence Rating | Career Relevance for US CMA Professionals |

|---|---|---|

| Investing in businesses and equity | Excellent | Reinforces capital budgeting and strategic analysis skills |

| Spending on education and research | Excellent | Enhances decision-making and performance management insight |

| Health and longevity | Very High | Mirrors risk management and resource preservation principles |

| Brand building and influence | High | Correlates with strategic financial planning for long-term ROI |

| Luxury assets like watches, cars | Moderate | Demonstrates discretionary expense evaluation |

| Excessive lifestyle inflation | Low | Illustrates poor capital allocation and risk awareness |

This table shows that billionaire spending often embodies principles taught in the US CMA program. The focus on value, efficiency, and strategic allocation mirrors the frameworks students learn for managerial accounting, performance evaluation, and capital budgeting.

Strategic Investment Before Consumption

Billionaires consistently prioritize investment over personal consumption. Profits are reinvested into businesses, real estate, or scalable assets before discretionary spending is considered. Even personal luxury purchases often serve a dual purpose, such as enhancing branding or professional influence.

For US CMA aspirants, this behavior exemplifies the concept of capital allocation. Learning to allocate limited resources to high-impact opportunities before discretionary expenditures is a fundamental principle in the CMA curriculum and an essential skill for finance leadership.

Spending on Time and Efficiency

Another hallmark of billionaire behavior is prioritizing investments that save time or increase efficiency. Private travel, personal assistants, and optimized workflows are not indulgences—they are investments that allow individuals to focus on strategic decisions and high-value activities.

This mirrors the CMA concept of opportunity cost. Every hour saved by strategic investments in efficiency allows for higher-value activities, reflecting the same thinking students are trained to apply in managerial decision-making scenarios.

Health as a Strategic Asset

Billionaires treat health as a critical financial asset. Investments in wellness, preventive care, and personalized medicine protect their capacity to make strategic decisions over the long term.

In US CMA terms, this is analogous to risk management and resource protection. Just as a company protects key assets to sustain operational performance, professionals learn to evaluate risks and safeguard essential resources for long-term success.

Avoiding Lifestyle Inflation

Despite exponential wealth growth, many billionaires maintain relatively restrained lifestyles. Excessive lifestyle inflation increases recurring costs and reduces financial flexibility.

For CMA aspirants, this highlights the importance of cost behavior analysis and financial discipline. The principle of avoiding unnecessary fixed costs while allocating resources strategically is directly aligned with concepts in managerial accounting and financial planning.

Connecting Billionaire Habits to US CMA Skills

The spending decisions of billionaires provide a real-world demonstration of the principles US CMA candidates study. Concepts such as capital budgeting, performance management, cost control, risk assessment, and strategic decision making come alive when we observe how billionaires manage money.

For example, evaluating whether to spend on luxury versus investable assets mirrors cost-benefit analysis in managerial accounting. Prioritizing efficiency expenditures mirrors opportunity cost evaluation. Risk-conscious health and resource management mirror internal control and risk management frameworks taught in the CMA curriculum.

This direct connection between billionaire habits and US CMA skills reinforces the practical relevance of the certification for aspiring finance leaders.

Why FinStreet Is Ideal for US CMA Aspirants

FinStreet bridges the gap between exam preparation and real-world application. The institute not only prepares students for the US CMA exam but also emphasizes strategic thinking and professional decision-making skills inspired by real-world financial behavior, including lessons from high-net-worth individuals.

Students at FinStreet benefit from structured mentorship, personalized study plans, doubt-solving sessions, and practical case study discussions that simulate real corporate scenarios. The program ensures that every student develops both exam competence and professional acumen.

Official Website: https://www.finstreet.in

FinStreet Instagram: https://www.instagram.com/finstreetofficial

FinStreet YouTube: https://www.youtube.com/@FinStreet

Additional Resource: https://www.finstreet.in/us-cma

Long-Term Lessons for Finance Professionals

Studying billionaire spending habits teaches that wealth and financial success are sustained through strategic allocation, discipline, and long-term vision.

For US CMA professionals, the key takeaways include prioritizing investment, analyzing opportunity costs, evaluating risk, and aligning spending with strategic objectives. These skills enhance career prospects, making candidates highly effective in roles such as financial planning and analysis, strategic finance, management accounting, and advisory.

Conclusion

Billionaire spending habits are not just about personal wealth; they are practical lessons in financial discipline, strategic thinking, and resource management. Observing how high-net-worth individuals allocate their resources offers US CMA aspirants a powerful perspective on capital budgeting, performance management, and risk assessment.

By studying these habits and applying similar principles, finance professionals can develop a mindset that aligns with both successful exam preparation and long-term career growth. FinStreet’s US CMA program provides structured guidance to bridge theory with real-world decision making, ensuring students are ready to excel in both exams and professional finance roles.

Call to Action

Enroll in FinStreet’s US CMA program today.

Book a free counselling session with a US CMA mentor.

Join FinStreet’s CMA newsletter for weekly finance and career insights.

Explore real-world case studies and career guidance at https://www.finstreet.in/us-cma.